Important Benefits To Know About Virtual Bookkeeping

Do you want to spend countless hours on bookkeeping and accounting for your business? Have you considered switching to virtual bookkeeping? Virtual bookkeeping is an innovative solution becoming increasingly popular among businesses of all sizes. This article will explore the important benefits of virtual bookkeeping and how it can help you streamline your financial processes and grow your business.

What is Virtual Bookkeeping?

Virtual bookkeeping is a type of bookkeeping service that is conducted entirely online. Instead of having an in-house bookkeeper or outsourcing a traditional accounting firm, you hire a virtual bookkeeper who works remotely is known as virtual bookkeeping. The virtual bookkeeper uses cloud-based accounting software to manage your financial transactions, reconcile accounts, generate reports, and more.

Please click here for more information: t2 incorporated return

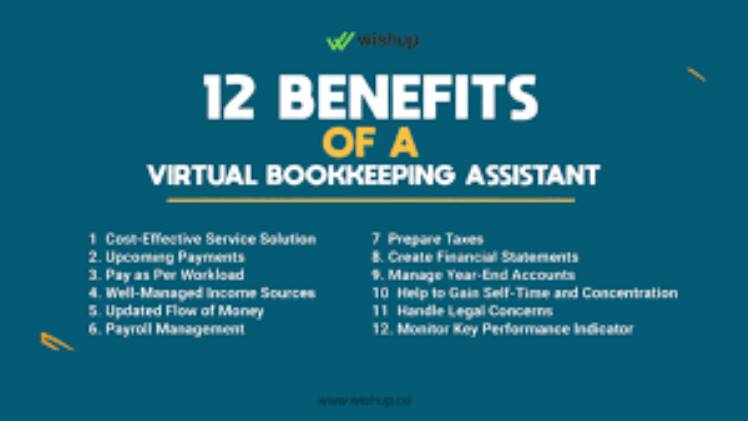

Benefits of Virtual Bookkeeping

Virtual bookkeeping services are changing the way small businesses manage their finances. While many companies still rely on an in-house bookkeeper, there are significant benefits to outsourcing this function to a virtual bookkeeper. Here are some of the most important benefits of virtual bookkeeping that businesses should consider:

Cost Savings

The key benefit of virtual service is cost savings. Since virtual bookkeepers work remotely and do not need office space, benefits, insurance, and other overhead expenses, they can offer lower hourly rates. Businesses can save 20% to 40% compared to hiring an in-house bookkeeper. Some virtual bookkeeping services provide the added convenience of fixed monthly fees. Overall, the lower operational expenses of virtual bookkeepers are often passed on through competitive pricing.

Access to Expertise

Many virtual bookkeepers have years of experience working with businesses in various industries. They bring this valuable expertise and best practices to bear on your finances. An in-house bookkeeper may be good but may lack the breadth of experience of a virtual bookkeeper. You get access to higher expertise at a lower cost.

Flexibility

Virtual bookkeepers can work whenever and wherever is convenient for them. They often offer services outside of traditional 9-5 hours. This flexibility matches the needs of growing businesses with variable cash flows and financial demands. An in-house bookkeeper tends to work set hours that are scheduled in advance.

Scalable

As a business grows, scaling up an in-house bookkeeper’s hours to match demand can be difficult. Adding a second full-time bookkeeper can be expensive. However, hiring another virtual bookkeeper is scalable and allows you to meet growth demands affordably. Virtual bookkeeping can easily scale up and down as needed.

Less Distraction

Reduced disruption to your organization is another advantage of outsourced virtual bookkeeping. An in-house bookkeeper who works on-site can sometimes distract other employees and interrupt the workflow. In contrast, outsourced bookkeeping services work remotely and mainly communicate virtually through tools like cloud accounting software, email, and phone. This minimizes the disruption they cause within your office environment, allowing your team to remain focused on their tasks.

Cloud Collaboration

Virtual bookkeepers rely on cloud-based software applications to manage their books remotely. This allows for real-time collaboration and data access. You and your team can instantly view your finances, generate reports, and sign off on transactions. This level of integration and transparency is not possible with an in-house bookkeeper.

Automatic Processes

Virtual bookkeepers can focus their time on more value-added work by automating many repeat tasks through software. They can set up automatic payments, invoice scheduling, payroll runs, and bank reconciliations. This allows them to work more efficiently and catch errors earlier.

Continuity

Virtual bookkeepers tend to stay with clients for longer periods. This continuity allows them to become experts on your business and finances. They understand operations, expenses, cash flows, contracts, and other nuances over time. This helps make better recommendations and detect issues early.

Conclusion

In summary, virtual bookkeeping services provide many important benefits for growing businesses. The potential cost savings compared to hiring an in-house bookkeeper can be significant, helping businesses control expenses. Outsourced virtual bookkeepers also introduce less disruption and distraction within your organization as they work remotely. Combined with the convenience of anytime access, outsourced bookkeeping allows businesses to streamline operations and focus on their core competencies. Switching to a virtual bookkeeping solution can help improve efficiency, transparency, and financial control – providing the freedom to operate and grow your business.