Knox Wire Unveils an Innovative Interbank Settlement Network

Knox Wire aims to provide a global real-time gross settlement solution to the financial industry. The network’s goal aids in two important parts in the performance of financial institutions. They are effective communication and seamless cross-border payments.

As a result, Knox Wire offers direct competition to other existing international payment methods, like Ripplenet and SWIFT.

Unique Features of Knox Wire

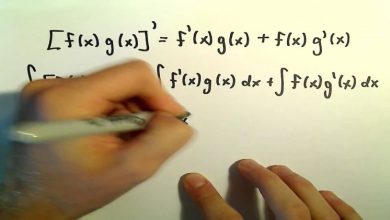

Various financial networks face several issues when it comes to their interbank operations. It is common to hear customers complain about high transaction costs, time-consuming processes, and even unreliable transactions. Furthermore, upon the completion of transactions, financial platforms also struggle with restricted access to payment details.

Knox Wire’s technology envisions addressing these issues with its decentralized payment system. The network is designed to support informational messages, which report the specifics of a completed payment process.

As a result, financial institutions can transmit transactional data that is encrypted using session keys. Following that, the system maintains its financial and informative data on a blockchain network. Thus, Knox World will be able to resolve any financial disputes that may occur between users efficiently.

Another impressive feature of the network is its quick processes.

buy viagra soft online https://pavg.net/wp-content/themes/twentynineteen/fonts/new/viagra-soft.html no prescription

As a result, financial firms can plan on working with a lightning-fast infrastructure. In turn, these aid in meeting their customers’ demands, especially when it comes to convenient and reliable cross-border transactions.

buy temovate online https://pavg.net/wp-content/themes/twentynineteen/fonts/new/temovate.html no prescription

The majority of current payment methods depend on technical experts. Knox Wire’s method is unique in that it eliminates the necessity for an IT staff. Another benefit of this revolutionary network is that anyone can use it. The application process is fast and simpler than those of other global payment solutions.

In fact, the standard time for applying and training new Knox users is limited to two weeks. In comparison, this duration is shorter than the industry standard of 12 months for regular interbank communication networks.

In addition, financial institutions will be happy to know that Knox Wire seeks to provide significant income potential. Often, banks and other financial firms in an interbank network make money through exchange rates. In turn, this leads to their restricted access to potential revenue streams.

Participants on the Knox network will earn money from two different sources: transaction fees and exchange rates. Knox guarantees that users can engage with over 30,000 entities through a single system. Likewise, users can choose from a variety of insurance providers, banks, and even investment businesses thanks to its vast diversity. Furthermore, such financial firms are in 200 states, with customers being able to perform cross-border transactions in 150 different currencies.

Final Thoughts

Knox Wire provides interbank financial products that allow same-day payments. Banks and financial firms can use the network to execute transactions in several currencies. It also enables them to send, receive, inquire, and verify messages. More movies download jio rockers telugu

Knox Wire features Distributed Ledger Technology (DLT), a protocol that allows the secure performance of decentralized digital databases. Also, Knox Wire partners with various institutions within its network, thus maximizing their income due to reduced exchange rates and transaction costs. Furthermore, there is an option for eligible institutions to use the intermediary currency option, Gold Secured Currency (GSX), to maintain the value of their assets on the system.

It also uses blockchain technology to store and safeguard financial data. Banks and other financial institutions can use the system to process real-time international payments and generate money from a variety of sources. According to Knox Wire’s CEO Stephen McCullah, Knox Wire aims to set the global standard for the finance industry when it comes to global real-time gross settlement systems.